Gross annual income calculator

AGI gross income adjustments to income. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

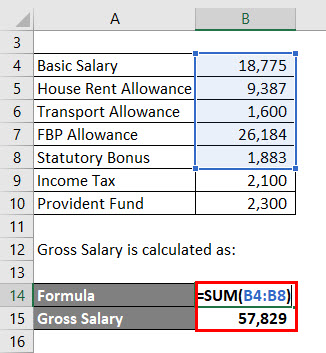

Salary Formula Calculate Salary Calculator Excel Template

If you make 55000 a year living in the region of New York USA you will be taxed 11959.

. 25000 x 12. The calculator uses necessary basic information like annual salary rent paid tuition fees interest on childs education loan and any other savings to calculate the tax liability of an individual. Follow these simple steps to calculate your salary after tax in Philippines using the Philippines Salary Calculator 2022 which is updated with the 202223 tax tables.

Enter the gross hourly earnings into the first field. The calculator calculates gross annual income by using the first four fields. Heres the breakdown.

Gross income the sum of all the money you earn in a year. Well use the monthly gross salary from our previous example and multiply it by 12. To convert from your net annual income to your gross annual income you can use this simple formula.

You can calculate your AGI for the year using the following formula. You can calculate your take home pay based on your gross income PAYE NI and tax for 202223. Lets work through how to calculate the yearly figure by using a simple example.

Gross Annual Income of hours worked per week x. That means that your net pay will be 43041 per year or 3587 per month. Number of hours worked each week x hourly rate x 52 annual gross income.

In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work. Multiply the amount of hours you work each week by your hourly salary. This yearly salary calculator will calculate your.

You can change the calculation by saving a new Main income. If you earn 15 per hour and work 40 hours per week your weekly gross salary is. All other pay frequency inputs are assumed to be holidays and vacation.

The PAYE Calculator will auto calculate your saved Main gross salary. To use this annual income. Your average tax rate is.

To convert to annual income. Once youve figured out your yearly salary check which tax. Example of Annual Income Calculator.

You may use an alternate equation to calculate your AGI. Simply enter your annual salary and click calculate or switch to the advanced tax calculator to. Enter Your Salary and the.

The tool can serve as an annual net income calculator or as a gross annual income calculator depending on what you want. Effective Income Tax Rate. How to Use the Annual Income Calculator.

Multiply that amount by 52 the number of weeks in a year the number of weeks in a year. Net salary calculator from annual gross income in Ontario 2022. This is the income tax you will have to pay as a percentage of your gross income.

Net income 1 - deduction rate For example if your net income was. It can be any hourly weekly or annual before tax. Assume that Sally earns 2500 per hour at her job.

Compute your annual gross salary first.

Salary Formula Calculate Salary Calculator Excel Template

Annual Income Calculator

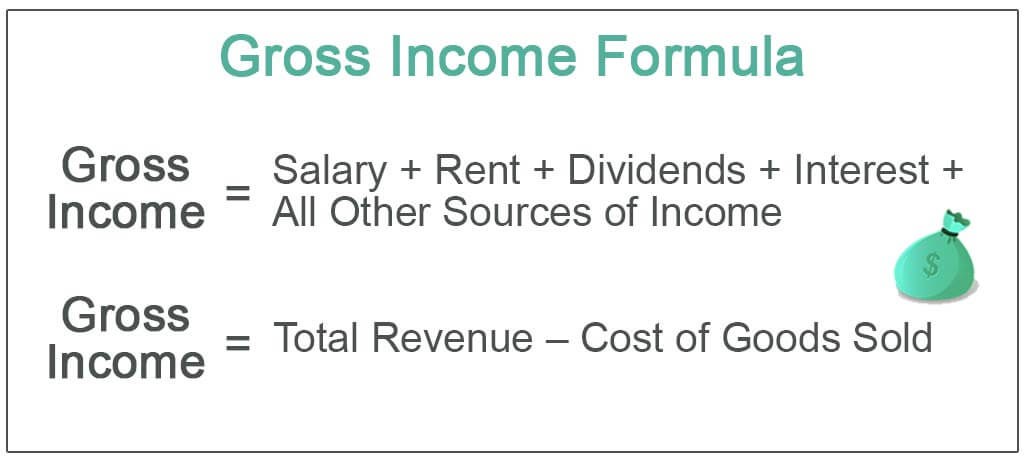

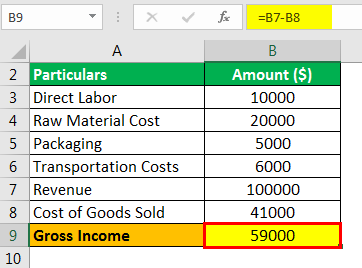

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

How To Calculate Gross Income Per Month

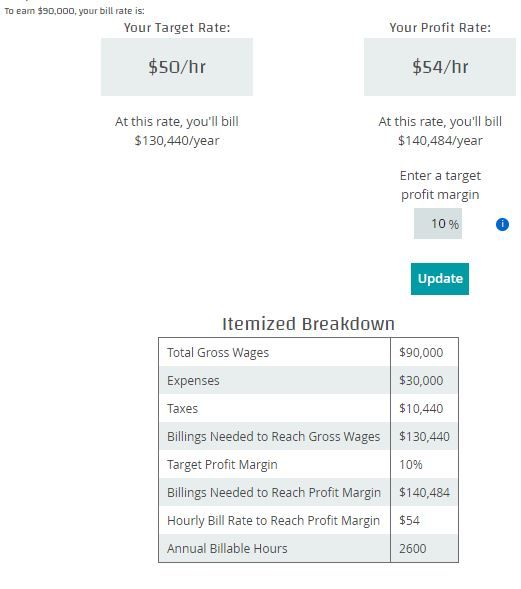

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

Gross Income Formula Step By Step Calculations

Annual Income Definition Calculation And Quiz Business Terms

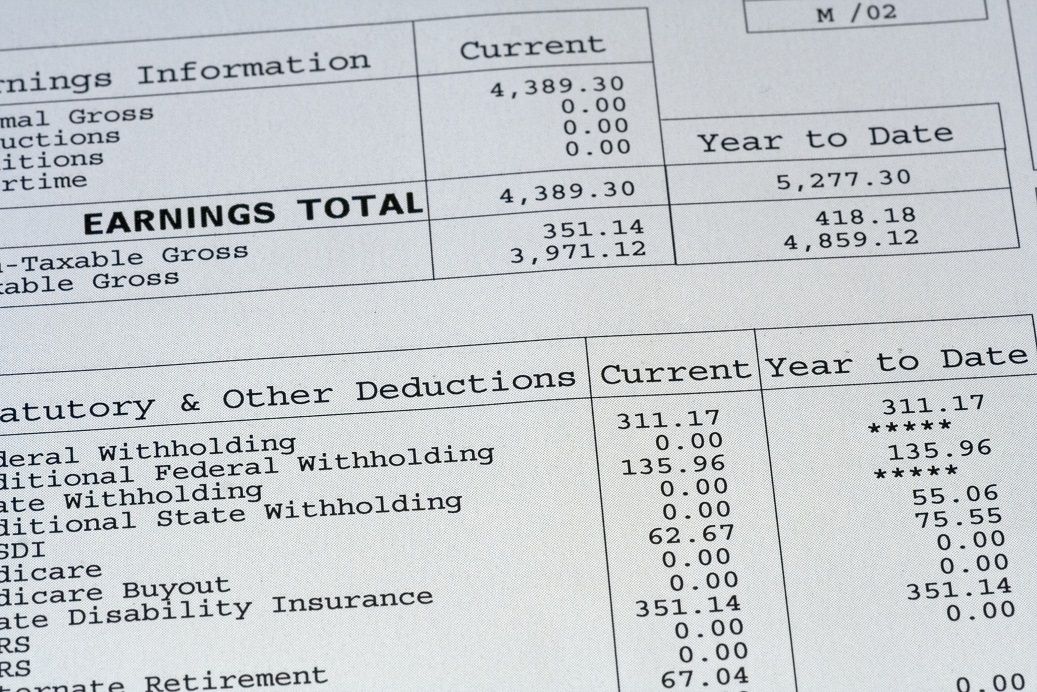

Gross Pay And Net Pay What S The Difference Paycheckcity

Annual Income Calculator

Salary Formula Calculate Salary Calculator Excel Template

Gross Pay And Net Pay What S The Difference Paycheckcity

4 Ways To Calculate Annual Salary Wikihow

Gross Income Formula Step By Step Calculations

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Pay Definition Components And How To Calculate